Trading plan for 8/23...

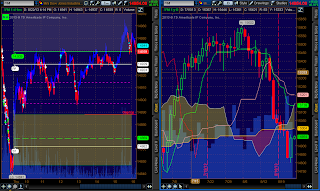

1. We are currently trading under the cloud. The bottom of the cloud in theory will act as a zone of resistance. We will use this as both a target and a place to initiate a possibility of a fade play.

2. Also the cloud is located at the top of the large downward candle from Wednesday, this is an area of interest to us, if we breach this area we will look to take on long positions.

3. We will have new home sales released at 10:00am. Any positive news will add fuel to the small rally we are seeing.

4. And as usual we will look begin by assessing the gap, and whether we are trending or sideways. From there use our S/R levels in coordination with our market internals to take positions.

News:

New Home Sales 10:00am EST

Thursday, August 22, 2013

review 8/22

review for 8/22

As we noted last night the TRIN trade was triggered. We waited and initiated a trade in the later part of the evening. This ended up being a simple and profitable setup for us. We were also in position for today's large market rally.

Looking forward we will want to keep and eye on the price and see if this rally is sustainable.

As we noted last night the TRIN trade was triggered. We waited and initiated a trade in the later part of the evening. This ended up being a simple and profitable setup for us. We were also in position for today's large market rally.

Looking forward we will want to keep and eye on the price and see if this rally is sustainable.

Wednesday, August 21, 2013

ym 8/22

Trading for 8/22

1. We are expecting another bearish day. We have seen a bearish close below the cloud. Since we like trading with the trend any entry that presents it self to the short side I would take.

2. We have jobless claims at 8:30am this will most likely create a prime trading opportunity so be on the lookout for that.

3. As usual we will continue to trade with the trend and look for price action at our S/R levels.

4.One thing to note is that the TRIN closed > 1.5 this is a trade that Hubert Senters often promotes. This requires wider stops. This will be interesting b/c its a fade move so we will wait till the late evening and make an assessment if this trade setup seems viable.

Notable new releases:

1. Jobless claims 8:30am

2.PMI Manufacturing Flash Index 8:58am

1. We are expecting another bearish day. We have seen a bearish close below the cloud. Since we like trading with the trend any entry that presents it self to the short side I would take.

2. We have jobless claims at 8:30am this will most likely create a prime trading opportunity so be on the lookout for that.

3. As usual we will continue to trade with the trend and look for price action at our S/R levels.

4.One thing to note is that the TRIN closed > 1.5 this is a trade that Hubert Senters often promotes. This requires wider stops. This will be interesting b/c its a fade move so we will wait till the late evening and make an assessment if this trade setup seems viable.

Notable new releases:

1. Jobless claims 8:30am

2.PMI Manufacturing Flash Index 8:58am

Sunday, August 18, 2013

ym 8/18

Trading plan...

1. We are coming off a 3 day downtrend. Observing the chart on the left I would keep an eye on price action and the possibility of price using the cloud as support. We have also developed a inverted hammer, which could create an end to the downward trend we are seeing.

2. Given the above information I would observe how the extended session trades and how price reacts to the cloud. If we start to see a reversal join the trend. Keep in mind we could see a few days of consolidation.

3. If we start to see signs of a reversal I would be hesitant on fading a gap up situation. But would be inclined to play in the direction of the trend.

1. We are coming off a 3 day downtrend. Observing the chart on the left I would keep an eye on price action and the possibility of price using the cloud as support. We have also developed a inverted hammer, which could create an end to the downward trend we are seeing.

2. Given the above information I would observe how the extended session trades and how price reacts to the cloud. If we start to see a reversal join the trend. Keep in mind we could see a few days of consolidation.

3. If we start to see signs of a reversal I would be hesitant on fading a gap up situation. But would be inclined to play in the direction of the trend.

Subscribe to:

Posts (Atom)