video for market outlook for /ym 10/15

1. Bearish divergence on the RSI , also there is a slight divergence on the on balance. Meaning that price is making new highs but both the RSI and the OBV are showing lower highs. This means keep your eyes peeled for good short opportunities.

2. Monitor the market internals (TICK and TRIN), pivots and VA.

Monday, October 14, 2013

Thursday, October 10, 2013

/ym 10/11

video for market outlook for /ym 10/11

Big day to see who is in charge, line is drawn around 15032. I would recommend using that as a reference. A lot of shorts have lost money today so this will be interesting to see how the bears react to today's market action.

Big day to see who is in charge, line is drawn around 15032. I would recommend using that as a reference. A lot of shorts have lost money today so this will be interesting to see how the bears react to today's market action.

Tuesday, October 8, 2013

/ym for 10/9

video for market outlook for 10/9

1. Bearish action is expected, we are nearing the neckline of the head and shoulders pattern.

2. Over night TRIN trade setup has triggered, if this trade does not develop be ready for a major sell off in the morning, if it does develop I would collect profits before market open.

1. Bearish action is expected, we are nearing the neckline of the head and shoulders pattern.

2. Over night TRIN trade setup has triggered, if this trade does not develop be ready for a major sell off in the morning, if it does develop I would collect profits before market open.

Monday, October 7, 2013

/ym for 10/8

video for market outlook for /ym 10/8

1. All signs lead to a bearish day tomorrow.

2. If there is going to be any bullish action it will occur on a bounce around 14828. If this level is breached expect some heavy selling.

3. As usual keep an eye on market internals, pivots and price action around those levels.

1. All signs lead to a bearish day tomorrow.

2. If there is going to be any bullish action it will occur on a bounce around 14828. If this level is breached expect some heavy selling.

3. As usual keep an eye on market internals, pivots and price action around those levels.

Thursday, October 3, 2013

/ym for 10/4

trading plan for 10/4

1. Again we are still developing a head and shoulder pattern on the daily chart. Thus we will now focus on entries for short opportunities unless the market presents with a reason to go long in the morning.

2. Friday's are good gap fade days, again if we see a gap up this is a gift and we will take it, if we see a gap down be prepared for it to continue downward.

1. Again we are still developing a head and shoulder pattern on the daily chart. Thus we will now focus on entries for short opportunities unless the market presents with a reason to go long in the morning.

2. Friday's are good gap fade days, again if we see a gap up this is a gift and we will take it, if we see a gap down be prepared for it to continue downward.

live trade for the /ym 10/3

live trade video 10/3

1. Went short near open and targeted 40pts

2. Total trade time was around 15min

1. Went short near open and targeted 40pts

2. Total trade time was around 15min

Wednesday, October 2, 2013

/ym for 10/3

Trading plan...

1. Seeing a pretty head and shoulders pattern forming on the weekly, which will indicate that we should expect bearish action this week.

2. Also, as a trend trader we like following the trend which is down at the moment.

3. Thurs is a great day to fade gaps, an up gap would be a gift, I would be more skeptical on a down gap fade just because of this downtrend we are in.

4. As usual keep an eye on pivot levels, VA, and monitor the market internals for entries, stops and limits.

Wednesday, September 11, 2013

/ym for 9/12

Trading plan...

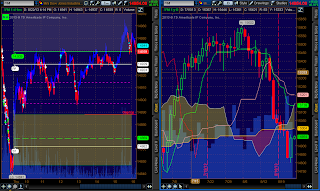

1. We have broken above the Ichimoku cloud this should in theory create support for the market. Thus this becomes an very interesting location to keep an eye on. If we dip below the cloud look to see how price acts on a test to determine if this is now resistance.

2. We are again looking bullish on Ichimoku other than the Chikou which is trading below price still.

3. Looking at the longer term picture we are beginning to develop a head and shoulders pattern on the daily chart so I wouldnt be surprised to see a price start down, but remember this will need confirmation. We like trading trends and we are in an up trend thus to short we will need confirmation.

4. As usual be on the look for a gap fade situation in the morning and keep and eye on the TICK, TRIN, and TIKI.

1. We have broken above the Ichimoku cloud this should in theory create support for the market. Thus this becomes an very interesting location to keep an eye on. If we dip below the cloud look to see how price acts on a test to determine if this is now resistance.

2. We are again looking bullish on Ichimoku other than the Chikou which is trading below price still.

3. Looking at the longer term picture we are beginning to develop a head and shoulders pattern on the daily chart so I wouldnt be surprised to see a price start down, but remember this will need confirmation. We like trading trends and we are in an up trend thus to short we will need confirmation.

4. As usual be on the look for a gap fade situation in the morning and keep and eye on the TICK, TRIN, and TIKI.

review for /ym 9/11

Review...

1. We broke highs for the previous day and the over night high within moments of market open. This creates conditions for taking long positions, but we will still need more confluence.

2. We had a bullish indications from Ichimoku which was the confluence to confirm our above theory. We had our eyes set on the top of the cloud which we penetrated by EOD. This now has the potential to act as support moving forward.

Overall this was a great day for a trend trader.

1. We broke highs for the previous day and the over night high within moments of market open. This creates conditions for taking long positions, but we will still need more confluence.

2. We had a bullish indications from Ichimoku which was the confluence to confirm our above theory. We had our eyes set on the top of the cloud which we penetrated by EOD. This now has the potential to act as support moving forward.

Overall this was a great day for a trend trader.

Tuesday, September 10, 2013

/ym 9/11

Trading plan...

1. We like fade plays on gaps on Wed. We will however have to keep an eye on this price channel developing overnight. If this development continues we will be apt to take positions in the direction of a breakout given the right criteria.

2. In terms of Ichimoku we are looking bullish so I would keep an eye for price moves towards the top of the cloud.

Notable News:

EIA Petroleum Status Report - 10:30AM

1. We like fade plays on gaps on Wed. We will however have to keep an eye on this price channel developing overnight. If this development continues we will be apt to take positions in the direction of a breakout given the right criteria.

2. In terms of Ichimoku we are looking bullish so I would keep an eye for price moves towards the top of the cloud.

Notable News:

EIA Petroleum Status Report - 10:30AM

Sunday, September 8, 2013

/ym 9/9

Trading plan for 9/9...

1. We like the morning gap moves. We will keep an eye on our key levels of S/R. Any breach of these with confirming volume and price action we take a position.

2. We like fading extreme TICK moves, so remember to keep those in mind when entering and exiting trades.

3. As usual we like trading market profile so also keep an eye out for developing S/R in terms of value area.

4. We will take trades on breaks of opening range but only with confirmation through price and volume.

1. We like the morning gap moves. We will keep an eye on our key levels of S/R. Any breach of these with confirming volume and price action we take a position.

2. We like fading extreme TICK moves, so remember to keep those in mind when entering and exiting trades.

3. As usual we like trading market profile so also keep an eye out for developing S/R in terms of value area.

4. We will take trades on breaks of opening range but only with confirmation through price and volume.

Thursday, August 22, 2013

ym for 8/23

Trading plan for 8/23...

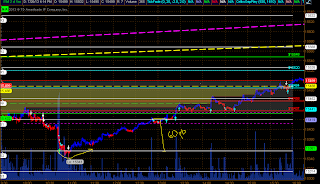

1. We are currently trading under the cloud. The bottom of the cloud in theory will act as a zone of resistance. We will use this as both a target and a place to initiate a possibility of a fade play.

2. Also the cloud is located at the top of the large downward candle from Wednesday, this is an area of interest to us, if we breach this area we will look to take on long positions.

3. We will have new home sales released at 10:00am. Any positive news will add fuel to the small rally we are seeing.

4. And as usual we will look begin by assessing the gap, and whether we are trending or sideways. From there use our S/R levels in coordination with our market internals to take positions.

News:

New Home Sales 10:00am EST

1. We are currently trading under the cloud. The bottom of the cloud in theory will act as a zone of resistance. We will use this as both a target and a place to initiate a possibility of a fade play.

2. Also the cloud is located at the top of the large downward candle from Wednesday, this is an area of interest to us, if we breach this area we will look to take on long positions.

3. We will have new home sales released at 10:00am. Any positive news will add fuel to the small rally we are seeing.

4. And as usual we will look begin by assessing the gap, and whether we are trending or sideways. From there use our S/R levels in coordination with our market internals to take positions.

News:

New Home Sales 10:00am EST

review 8/22

review for 8/22

As we noted last night the TRIN trade was triggered. We waited and initiated a trade in the later part of the evening. This ended up being a simple and profitable setup for us. We were also in position for today's large market rally.

Looking forward we will want to keep and eye on the price and see if this rally is sustainable.

As we noted last night the TRIN trade was triggered. We waited and initiated a trade in the later part of the evening. This ended up being a simple and profitable setup for us. We were also in position for today's large market rally.

Looking forward we will want to keep and eye on the price and see if this rally is sustainable.

Wednesday, August 21, 2013

ym 8/22

Trading for 8/22

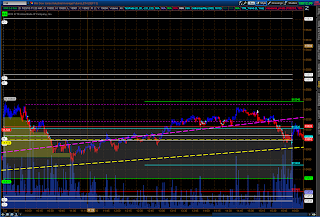

1. We are expecting another bearish day. We have seen a bearish close below the cloud. Since we like trading with the trend any entry that presents it self to the short side I would take.

2. We have jobless claims at 8:30am this will most likely create a prime trading opportunity so be on the lookout for that.

3. As usual we will continue to trade with the trend and look for price action at our S/R levels.

4.One thing to note is that the TRIN closed > 1.5 this is a trade that Hubert Senters often promotes. This requires wider stops. This will be interesting b/c its a fade move so we will wait till the late evening and make an assessment if this trade setup seems viable.

Notable new releases:

1. Jobless claims 8:30am

2.PMI Manufacturing Flash Index 8:58am

1. We are expecting another bearish day. We have seen a bearish close below the cloud. Since we like trading with the trend any entry that presents it self to the short side I would take.

2. We have jobless claims at 8:30am this will most likely create a prime trading opportunity so be on the lookout for that.

3. As usual we will continue to trade with the trend and look for price action at our S/R levels.

4.One thing to note is that the TRIN closed > 1.5 this is a trade that Hubert Senters often promotes. This requires wider stops. This will be interesting b/c its a fade move so we will wait till the late evening and make an assessment if this trade setup seems viable.

Notable new releases:

1. Jobless claims 8:30am

2.PMI Manufacturing Flash Index 8:58am

Sunday, August 18, 2013

ym 8/18

Trading plan...

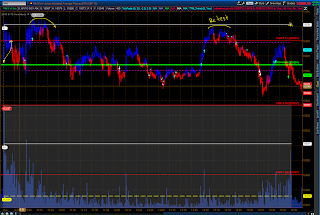

1. We are coming off a 3 day downtrend. Observing the chart on the left I would keep an eye on price action and the possibility of price using the cloud as support. We have also developed a inverted hammer, which could create an end to the downward trend we are seeing.

2. Given the above information I would observe how the extended session trades and how price reacts to the cloud. If we start to see a reversal join the trend. Keep in mind we could see a few days of consolidation.

3. If we start to see signs of a reversal I would be hesitant on fading a gap up situation. But would be inclined to play in the direction of the trend.

1. We are coming off a 3 day downtrend. Observing the chart on the left I would keep an eye on price action and the possibility of price using the cloud as support. We have also developed a inverted hammer, which could create an end to the downward trend we are seeing.

2. Given the above information I would observe how the extended session trades and how price reacts to the cloud. If we start to see a reversal join the trend. Keep in mind we could see a few days of consolidation.

3. If we start to see signs of a reversal I would be hesitant on fading a gap up situation. But would be inclined to play in the direction of the trend.

Sunday, August 4, 2013

/ym for 8/5

Plan for 8/5...

1. We will keep an eye on the gap situation. We are trading close to the month highs in the extended session at the moment. If we break this level we will look for either a breakout or a failed breakout.

2. Not much in terms of news tomorrow so this will keep the markets less volatile. Since we ended last week in an uptrend we will want to see if this carries over to this week.

3. We will use our S/R and VA's to help guide our trading. Our key here is to first determine whether we are trending or range bound. Once we can establish which it is we can make the appropriate trades.

1. We will keep an eye on the gap situation. We are trading close to the month highs in the extended session at the moment. If we break this level we will look for either a breakout or a failed breakout.

2. Not much in terms of news tomorrow so this will keep the markets less volatile. Since we ended last week in an uptrend we will want to see if this carries over to this week.

3. We will use our S/R and VA's to help guide our trading. Our key here is to first determine whether we are trending or range bound. Once we can establish which it is we can make the appropriate trades.

Thursday, August 1, 2013

review /ym 8/1

Lets review our trading plan...

1. We did not take the gap this morning (first of the month is a bad time for gap fills, also this was a large gap) and actually rode the trend from 15558 and set our limit at 15582 this trade was quick and we netted 24pts in 10min. We took this trade because we opened above the month high, we were in an up trend and had overhead resistance in the range of 15581-15591.

2. R1 @ 15595 has gained our interest since it was tested twice and held both times. This level will be monitored closely.

1. We did not take the gap this morning (first of the month is a bad time for gap fills, also this was a large gap) and actually rode the trend from 15558 and set our limit at 15582 this trade was quick and we netted 24pts in 10min. We took this trade because we opened above the month high, we were in an up trend and had overhead resistance in the range of 15581-15591.

2. R1 @ 15595 has gained our interest since it was tested twice and held both times. This level will be monitored closely.

Wednesday, July 31, 2013

/ym for 8/1

Plan for 8/1...

1. We don't like gaps on the first of months so this an unlikely play for us.

2. We will be interested in making plays based on our S/R levels and how price is acting in the areas. Any break of 15564 to the upside will create a good trading opportunity. Also if we break 15431 on the downside we will have another great opportunity. But if these don't appear we will look to our S/R and VA for trading opportunities.

3. We also have 2 news events which should shake up the market a bit. We are smart traders and these are things we want to be aware of.

4. And as usual we will be huge fans of TICK plays.

Important news:

Jobless Claims 8:30 am

ISM Mfg Index 10:00am

1. We don't like gaps on the first of months so this an unlikely play for us.

2. We will be interested in making plays based on our S/R levels and how price is acting in the areas. Any break of 15564 to the upside will create a good trading opportunity. Also if we break 15431 on the downside we will have another great opportunity. But if these don't appear we will look to our S/R and VA for trading opportunities.

3. We also have 2 news events which should shake up the market a bit. We are smart traders and these are things we want to be aware of.

4. And as usual we will be huge fans of TICK plays.

Important news:

Jobless Claims 8:30 am

ISM Mfg Index 10:00am

review for /ym 7/31

Let review today's market action...

1. We bought at the open playing a small gap. We liked seeing that the open was above the VAH and the High of the 29th. This creates a level of support and we went long with a target around yesterdays high and R1. We hit and netted 50pts.

2. Another great trading opportunity was when it broke out about its month high. Either we will see it break out to the up side or fail both are great entry points. We see that it failed.

3. Our 1 hour level of support held well and we will continue to monitor this area.

4. We also saw the FOMC create some choppiness in the market around 2pm. Hubert Senters has a trade which would have worked well in this situation(FOM 1-2-3 trade...Google it).

1. We bought at the open playing a small gap. We liked seeing that the open was above the VAH and the High of the 29th. This creates a level of support and we went long with a target around yesterdays high and R1. We hit and netted 50pts.

2. Another great trading opportunity was when it broke out about its month high. Either we will see it break out to the up side or fail both are great entry points. We see that it failed.

3. Our 1 hour level of support held well and we will continue to monitor this area.

4. We also saw the FOMC create some choppiness in the market around 2pm. Hubert Senters has a trade which would have worked well in this situation(FOM 1-2-3 trade...Google it).

Tuesday, July 30, 2013

/ym for 7/31

Took a few days off but let get started again...

1. Depending on the gap situation we will want to take that. We like Wed, Thurs and Fri for gap plays and especially the last day of the month. We however will need to check the charts in the morning to see the size and how it has traded over night.

2. We will have 2 important new releases which may create good trading opportunities for us. Remember panic is our friend. So keep a close eye on the markets around these times. I will be watching the TICK's, TIKI's, and how price is acting around our levels of S/R.

3. Seems like we our building some support around 15421-15431 area and would also be interested to see how price reacts if it gets down there.

Important news releases:

These are 2 that we want to be aware when trading tomorrow.

GDP 8:30am

FOMC Meeting Announcement 2:00pm

1. Depending on the gap situation we will want to take that. We like Wed, Thurs and Fri for gap plays and especially the last day of the month. We however will need to check the charts in the morning to see the size and how it has traded over night.

2. We will have 2 important new releases which may create good trading opportunities for us. Remember panic is our friend. So keep a close eye on the markets around these times. I will be watching the TICK's, TIKI's, and how price is acting around our levels of S/R.

3. Seems like we our building some support around 15421-15431 area and would also be interested to see how price reacts if it gets down there.

Important news releases:

These are 2 that we want to be aware when trading tomorrow.

GDP 8:30am

FOMC Meeting Announcement 2:00pm

Saturday, July 27, 2013

review /ym 7/26

Time to review our plan...

1. Fading the gap when we see our entry (hammer or blue TTM candle) would have resulted in us getting stopped out. We can see that price pushes through our first level of support. This would have been a good place to short with a small stop with a target of S2.

2. We observed a extreme TICK reading right around our S2 level. This sparks our interest, we now wait for a hammer or a blue TTM candle and will go long. We wait and then our entry criteria appears and we go long. With little heat we collect 60pts.

3. As price moves upward we see it enter the VA. Now we wait to see if the 80% rule criteria is met. It is and we go long. Our target is the top of the VA or EOD we dont like holding positions over night. We collect 60-70pts with little heat.

1. Fading the gap when we see our entry (hammer or blue TTM candle) would have resulted in us getting stopped out. We can see that price pushes through our first level of support. This would have been a good place to short with a small stop with a target of S2.

2. We observed a extreme TICK reading right around our S2 level. This sparks our interest, we now wait for a hammer or a blue TTM candle and will go long. We wait and then our entry criteria appears and we go long. With little heat we collect 60pts.

3. As price moves upward we see it enter the VA. Now we wait to see if the 80% rule criteria is met. It is and we go long. Our target is the top of the VA or EOD we dont like holding positions over night. We collect 60-70pts with little heat.

Friday, July 26, 2013

/ym for 7/26

Trade plan for 7/26...

1. Again we are seeing a large gap down. This is 2 consecutive days with gaps in the 80 range. We will fade using our rules but use small stops with 20pts targets. This will protect some of our profits if this gap doesnt fully or half fill.

2. We will also look for potential pivot plays. If this short term down trend holds we would prefer shorting opportunities as opposed to longs. Trend is our friend.

3. Also we like plays that involve extreme TICK readings. Just keep an eye out for those and trade in the direction of the trend, this will give us a better probability of success.

1. Again we are seeing a large gap down. This is 2 consecutive days with gaps in the 80 range. We will fade using our rules but use small stops with 20pts targets. This will protect some of our profits if this gap doesnt fully or half fill.

2. We will also look for potential pivot plays. If this short term down trend holds we would prefer shorting opportunities as opposed to longs. Trend is our friend.

3. Also we like plays that involve extreme TICK readings. Just keep an eye out for those and trade in the direction of the trend, this will give us a better probability of success.

Thursday, July 25, 2013

review /ym 7/25

Let us review the trading plan for today...

1. Plan was to fade gap with 20 pts targets on either the first hammer or the first blue TTM bar. This would have netted us 20pts. After we saw that 15458 which we had highlighted on our chart as a level of resistance hold and then the market rolled over.

2. In the afternoon we saw the price rebound and begin upward again and enter the VA. This presents an interesting trading situation as with Market Profile there is the 80% rule (look it up) but this trade appeared. We can see that it worked and the whole VA was filled and the top acted as resistance.

3. Also we can see that the whole gap filled by the end of the day. This shows the strength of the market. This strength made us weary to fade any moves against it (few times TICK fading opportunities appeared).

1. Plan was to fade gap with 20 pts targets on either the first hammer or the first blue TTM bar. This would have netted us 20pts. After we saw that 15458 which we had highlighted on our chart as a level of resistance hold and then the market rolled over.

2. In the afternoon we saw the price rebound and begin upward again and enter the VA. This presents an interesting trading situation as with Market Profile there is the 80% rule (look it up) but this trade appeared. We can see that it worked and the whole VA was filled and the top acted as resistance.

3. Also we can see that the whole gap filled by the end of the day. This shows the strength of the market. This strength made us weary to fade any moves against it (few times TICK fading opportunities appeared).

/ym for 7/25

Trading plan:

1. Gap is very large so I would fade with 20pt targets. Wait for either blue TTM or hammer which ever come first.

2. Extreme TICK moves are our friend and we will look to fade them in the direction of the trend if possible.

3. If range bound then we will use S/R with price action as our trading guide

1. Gap is very large so I would fade with 20pt targets. Wait for either blue TTM or hammer which ever come first.

2. Extreme TICK moves are our friend and we will look to fade them in the direction of the trend if possible.

3. If range bound then we will use S/R with price action as our trading guide

Wednesday, July 24, 2013

review 7/24 for /ym

Lets review our trading plan

1. I am not the biggest fan of fading gap up situations but since the /ym gapped up to the high of yesterday we will place a small stop and fade it. We used the high of yesterday as a level of resistance. This worked out and was an easy 30pts for us. Fading both the half and full gap fill would have caused us to get stopped out. This happens it comes with being a trader.

2. As we expected we saw that at 10:00 am the New Home Sales created a panic in the market.

3. Towards the end of the day we saw some extreme TICK moves and were able to fade them to our VA and collect a rough 30pts.

Overall it was a great day to be a trader. There were plenty of opportunities but the key is we continue to follow our trading plan.

1. I am not the biggest fan of fading gap up situations but since the /ym gapped up to the high of yesterday we will place a small stop and fade it. We used the high of yesterday as a level of resistance. This worked out and was an easy 30pts for us. Fading both the half and full gap fill would have caused us to get stopped out. This happens it comes with being a trader.

2. As we expected we saw that at 10:00 am the New Home Sales created a panic in the market.

3. Towards the end of the day we saw some extreme TICK moves and were able to fade them to our VA and collect a rough 30pts.

Overall it was a great day to be a trader. There were plenty of opportunities but the key is we continue to follow our trading plan.

Tuesday, July 23, 2013

/ym for 7/24

Trading plan for 7/24

1. Always check the gap situation. Gaps downs are gifts. Purple line is longer term trend and yellow is short term trend. Wednesday is also a favorable day of the week for gaps but this fact alone doesnt make the choice for us.

2. We have new Home Sales coming out at 10:00am ET this will be noteworthy. Depending on how the market reacts we can be presented with some great panic plays. Panic is our friend.

3. We like trading with the trend but if the market becomes range bound we will use our S/R levels in relation to price action to determine positions to take.

Notable News releases:

PMI Manufacturing Index Flash-8:58 am

New Home Sales 10:00 am

EIA Petroleum Status Report 10:30am

review /ym 7/23

Let us review our trading plan for 7/23

1. We like playing the gaps on the /ym. Our plan was a conservative one due to the size of the gap (>40) but we still managed to collect 16pts on a half gap fill and took almost no heat on the trade.

2. Once we exited the trade we saw it continue downward and eventually fill. Cant win them all.

3. This gap filling creates another great trade opportunity. Fading gap fills is a play I like to take especially during an uptrend. Remember we said we like trading with the trend. With a target set at the top of the gap we were able to net roughly 40 pts again with minimal heat.

4. Now if you noticed we can see that at our R1 level TTM stayed blue as it tested this level. This is another play that could have been done with a limit of either the days high or R2. This was not in the trading plan but still worth noting.

5. 2 trades-Net total: 56pts

/ym for 7/23

Today plan of attack:

1. What is the trend? We are seeing an up trend.

2. We will play the gap unless the price breaks 15541. This is our S/R level. If this isnt broken we are expecting a gap up so we will look for the first red/hammer and enter the trade. If the gap is fairly large (>30pts) we will use the half gap fill as target 1 and then trail our stop once this has been hit.

3. As we normally do once the market settles will will determine if the day is range bound or trending. This will help us to determine our moves. If range bound will will look for S/R levels and how price is acting in those areas. If trending we will trade with the trend.

1. What is the trend? We are seeing an up trend.

2. We will play the gap unless the price breaks 15541. This is our S/R level. If this isnt broken we are expecting a gap up so we will look for the first red/hammer and enter the trade. If the gap is fairly large (>30pts) we will use the half gap fill as target 1 and then trail our stop once this has been hit.

3. As we normally do once the market settles will will determine if the day is range bound or trending. This will help us to determine our moves. If range bound will will look for S/R levels and how price is acting in those areas. If trending we will trade with the trend.

Monday, July 22, 2013

review of /ym 7/22

So today we a few interesting things happen

- 1. We wanted to see a gap down...during an uptrend a gap down is a gift and a play we would like to take.

- So we waited and bought the first blue TTM or hammer (lucky for us this happened at the same time). This occurred at 15472, place a stop and then wait for the fill. We took a little heat on the trade (10pts) but we have a trading plan and we stick to it.

- By 11:08 EST we saw the gap fill and net us roughly 41pts, not bad for an hour of work.

- 2. We did not see the price break 15525 or 15535 so we did not have any interest in a upward move.

- 3. No extreme TICKs, this made for a fairly slow day for our trading plan.

Sunday, July 21, 2013

Disclaimer

Stock recommendations and comments presented on this site are solely those of myself.

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection. Various factors, including personal or corporate ownership, may influence or factor into an expert's stock analysis or opinion.

All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

Investors should be cautious about any and all stock recommendations and should consider the source of any advice on stock selection. Various factors, including personal or corporate ownership, may influence or factor into an expert's stock analysis or opinion.

All investors are advised to conduct their own independent research into individual stocks before making a purchase decision. In addition, investors are advised that past stock performance is no guarantee of future price appreciation.

/YM for 7/22

- Gap play in the morning

- Buy the first hammer/color change on the TTM trend

- If gap up less likely to fill

- Gap down is a gift and will likely fill

- Trend line is showing upward momentum

- In the extended trading session we are seeing that R1 of 15525 is holding we also of the high of the previous day at 15535

- If price breaks both I would see how price action reacts and determine if we can move up to 15573

- Once market has settled I would start to play the ticks

- See how the tikis are effecting the markets and use TICKs as confirmation

- and use pivot plays depending on price action

Notable News

releases

- 10:00am-Existing Home Sales

Subscribe to:

Posts (Atom)