Lets review our trading plan...

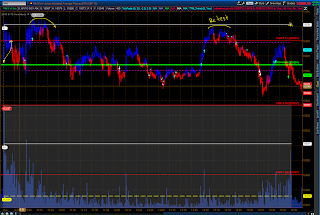

1. We did not take the gap this morning (first of the month is a bad time for gap fills, also this was a large gap) and actually rode the trend from 15558 and set our limit at 15582 this trade was quick and we netted 24pts in 10min. We took this trade because we opened above the month high, we were in an up trend and had overhead resistance in the range of 15581-15591.

2. R1 @ 15595 has gained our interest since it was tested twice and held both times. This level will be monitored closely.

Thursday, August 1, 2013

Wednesday, July 31, 2013

/ym for 8/1

Plan for 8/1...

1. We don't like gaps on the first of months so this an unlikely play for us.

2. We will be interested in making plays based on our S/R levels and how price is acting in the areas. Any break of 15564 to the upside will create a good trading opportunity. Also if we break 15431 on the downside we will have another great opportunity. But if these don't appear we will look to our S/R and VA for trading opportunities.

3. We also have 2 news events which should shake up the market a bit. We are smart traders and these are things we want to be aware of.

4. And as usual we will be huge fans of TICK plays.

Important news:

Jobless Claims 8:30 am

ISM Mfg Index 10:00am

1. We don't like gaps on the first of months so this an unlikely play for us.

2. We will be interested in making plays based on our S/R levels and how price is acting in the areas. Any break of 15564 to the upside will create a good trading opportunity. Also if we break 15431 on the downside we will have another great opportunity. But if these don't appear we will look to our S/R and VA for trading opportunities.

3. We also have 2 news events which should shake up the market a bit. We are smart traders and these are things we want to be aware of.

4. And as usual we will be huge fans of TICK plays.

Important news:

Jobless Claims 8:30 am

ISM Mfg Index 10:00am

review for /ym 7/31

Let review today's market action...

1. We bought at the open playing a small gap. We liked seeing that the open was above the VAH and the High of the 29th. This creates a level of support and we went long with a target around yesterdays high and R1. We hit and netted 50pts.

2. Another great trading opportunity was when it broke out about its month high. Either we will see it break out to the up side or fail both are great entry points. We see that it failed.

3. Our 1 hour level of support held well and we will continue to monitor this area.

4. We also saw the FOMC create some choppiness in the market around 2pm. Hubert Senters has a trade which would have worked well in this situation(FOM 1-2-3 trade...Google it).

1. We bought at the open playing a small gap. We liked seeing that the open was above the VAH and the High of the 29th. This creates a level of support and we went long with a target around yesterdays high and R1. We hit and netted 50pts.

2. Another great trading opportunity was when it broke out about its month high. Either we will see it break out to the up side or fail both are great entry points. We see that it failed.

3. Our 1 hour level of support held well and we will continue to monitor this area.

4. We also saw the FOMC create some choppiness in the market around 2pm. Hubert Senters has a trade which would have worked well in this situation(FOM 1-2-3 trade...Google it).

Tuesday, July 30, 2013

/ym for 7/31

Took a few days off but let get started again...

1. Depending on the gap situation we will want to take that. We like Wed, Thurs and Fri for gap plays and especially the last day of the month. We however will need to check the charts in the morning to see the size and how it has traded over night.

2. We will have 2 important new releases which may create good trading opportunities for us. Remember panic is our friend. So keep a close eye on the markets around these times. I will be watching the TICK's, TIKI's, and how price is acting around our levels of S/R.

3. Seems like we our building some support around 15421-15431 area and would also be interested to see how price reacts if it gets down there.

Important news releases:

These are 2 that we want to be aware when trading tomorrow.

GDP 8:30am

FOMC Meeting Announcement 2:00pm

1. Depending on the gap situation we will want to take that. We like Wed, Thurs and Fri for gap plays and especially the last day of the month. We however will need to check the charts in the morning to see the size and how it has traded over night.

2. We will have 2 important new releases which may create good trading opportunities for us. Remember panic is our friend. So keep a close eye on the markets around these times. I will be watching the TICK's, TIKI's, and how price is acting around our levels of S/R.

3. Seems like we our building some support around 15421-15431 area and would also be interested to see how price reacts if it gets down there.

Important news releases:

These are 2 that we want to be aware when trading tomorrow.

GDP 8:30am

FOMC Meeting Announcement 2:00pm

Subscribe to:

Posts (Atom)